Trusts & NGOs | Scheme of Taxation & Computation of Income

2. Overview of the Conditions and Scheme of Taxation

- The exemptions available under section 11 are subject to the conditions specified in sections 11, 12, 12A, 12AB and 13 of the Act.

- The organisation must be solely existing for the public benefit, and such organisation can be either religious or charitable in nature.

- Section 11 provides that the Income from trust property (subject to provision of sections 60 to 63 of the Income-tax Act, 1961) shall be subject to exemption as provided in clauses (a), (b), (c) and (d) of sub-section (1) of section 11. Hence, initially, one needs to compute the income of an organisation subject to exemption.

- Section 11(1)(a) begins with the words ‘income derived from property held under trust wholly for charitable or religious purposes……..’. The word ‘wholly’ refers to the object and not to the property held under trust. The trust should be wholly for charitable or religious purposes but it is not necessary that the property should be wholly with the trust.

- It may be noted that section 11(1)(a) uses the words “income derived from property held under trustwhollyfor charitable or religious purposes.…..”. This section does not distinguish between a private and public religious trust, therefore, as far as section 11 is concerned there is no difference between a public and private religious trust.

- Income shall be exempt to the extent applied for wholly for charitable or religious purposes in India and this exemption is also available to the income accumulated upto 15% of the income. [Section 11(1)(a)]

- If the organisation was created prior to 1-4-1962, then the exemption will be available even if it is partly for religious or charitable purposes. The income to the extent applied for religious or charitable purposes is exempt under section 11(1)(b) and the same condition of 85 per cent application would apply.

- Under section 11(1)(c) income of charitable or religious organisations is required to be applied in India only, unless the organisation is specifically permitted to work outside India or works for notified purposes which tend to promote international welfare in which India is interested.

Organisations created before 1-4-1952 can apply income outside India also. Organisations created on or after 1-4-1952 can apply income outside India for charitable purposes which tend to promote international welfare in which India is interested. These organisations will only get exemption under section 11 if the CBDT has permitted or notified such activity for charitable purposes outside India.

- Under section 11(1)(d) income in the form of voluntary contribution with a specific direction that they shall form part of corpus shall be exempt. The Finance Act, 2021 provides that the corpus donation shall be exempt only if invested or deposited in one or more of the forms or modes specified in Section 11(5) maintained specifically for such corpus. Thus, the corpus donation received by an organisation will not be treated as exempt income unless it is invested or deposited in one or more of the forms or modes specified in section 11(5) maintained specifically for such corpus.

- To cover the shortfall in application of 85%, Clause (2) of Explanation to section 11(1) provides for the option to apply the shortfall in application in subsequent year or in the year of receipt (subject to condition) and section 11(2) provides for accumulation of any part of income for specific purpose for five years, subject to certain conditions.

- Under section 11(1B) and section 11(3), income shall be subjected to tax if the conditions for option or accumulation as mentioned in previous para are not complied with.

- Explanation 2 to section 11(1) provides for disallowances of application amount regarding corpus grant to any institution approved under section 10(23C) or registered under section 12AA/12AB.

- Explanation 3 to section 11(1) provides for disallowance due to violation of TDS provisions & cash payments. If tax is deductible from any payment but it is not deducted and payment is made to a resident person, 30% of such amount will be disallowed. If payment for an expense exceeding ` 10,000 is made in cash or any impermissible mode; that payment or expense will not be considered while computing the application of income.

- Explanation 3A to Section 11(1) inserted by the Finance Act, 2022 provides that where the property held under a trust or institution includes any temple, mosque, gurdwara, church or other place notified under section 80G(2)(b), any sum received by such trust or institution as a voluntary contribution for renovation or repair of such temple, mosque, gurdwara, church or other place, may, at its option, be treated by such trust or institution as forming part of the corpus of the trust or the institution.

- Explanation 4 to Section 11(1) provides that application for charitable or religious purposes from the corpus as referred to in section 11(1)(d) shall not be treated as application of income for charitable or religious purposes. However, when such corpus donations are invested or deposited back, into one or more of the forms or modes specified in section 11(5) maintained specifically for such corpus, such amount shall be allowed as an application in the previous year in which it is deposited back to the corpus to the extent of such deposit or investment.

- Explanation 5 to section 11(1) provides that calculation of income required to be applied or accumulated during the previous year shall be made without any set off or deduction or allowance of any excess application of any of the year preceding the previous year.

- Capital gains are also required to be applied for charitable and religious purposes and therefore, it will amount to depletion of the corpus of the organisation. In order to overcome this disadvantage, the Income-tax Act has brought section 11(1A). Section 11(1A) provides for exemption of capital gain if these are utilised for acquiring another capital asset.

- Section 11(4) provides that “property held under trust” shall include a business undertaking so held and section 11(4A) provides exemption of income from incidental business activities on specified conditions.

- Section 11(5) together with Rule 17C provides for the modes where investment by a trust can be made.

- Section 11(6) of the Income Tax Act provides that depreciation shall not be allowed while computing income subject to application against those assets which have been treated as application in earlier years.

- Section 11(7) provides that exemption under section 10 shall not be available except income referred to in section 10(23C), 10(46) and section 10(1).

- The proviso to section 11(7) further provides that an organisation registered under section 12AB cannot simultaneously have approval under section 10(23C) or notified u/s 10(46). By amendment in section 11, it is clarified that the registration u/s 12AA/12AB shall be inoperative from the date on which the trust or institution has been approved under clause (23C) of section 10 or is notified under clause (46) of the Income-tax Act.

- The Finance Act, 2022 inserted Explanation to Section 11 to provide that any sum payable by any trust shall be considered as an application of income in the previous year in which such sum is actually paid by it irrespective of the previous year in which the liability to pay such sum was incurred by such trust according to the method of accounting regularly employed by it.

- Section 12(1) provides that any voluntary contributions received by a trust created wholly for charitable or religious purposes or by an institution established wholly for such purposes shall, for the purposes of section 11, be deemed to be income derived from property held under trust wholly for charitable or religious purposes. However, contribution received with a specific direction that they shall form part of the corpus of the trust or institution shall not be included in income for the purposes of section 11. In other words, voluntary contributions other than those towards corpus specific direction are deemed as income.

- Section 12A(1) provides conditions for applicability of sections 11 and 12. This sub-section provides that sections 11 and 12 shall not be applicable unless the conditions specified in sub-section (1) of section 12A are fulfilled. Conditions include registration under section 12AA/12AB, obtaining and furnishing of Audit report, submission of return, maintenance of books of account, etc.

- Proviso to sub-section (2) of section 12A provides for the benefit of registration even for earlier years once the registration is granted.

- Section 12AB provides the process of registration as well as the situation and process of cancellation of registration.

- Section 13 of the Act specifies the circumstances under which the benefits under sections 11 and 12 would not be available to an organisation. Section 13 has been enacted as an exception to section 11, and therefore, the benefits which are otherwise available under sections 11 and 12 will not be available under the circumstances stated in section 13.

- Section 13(10) and section 13(11) inserted by the Finance Act, 2022 provides for the computation of income in the specified circumstances when benefit of exemption is denied to the trusts or institutions under section 11 and 12.

3. Conditions to Claim Exemption

The exemptions available under section 11 are subject to the conditions specified in sections 11, 12, 12A, 12AA and 13 of the Act. Therefore, exemption is not available if various conditions, as are required to be followed, are not adhered to. This issue was pointed out in CIT v. Hyderabad Secunderabad Foodgrains Association Ltd. [1988] 41 Taxman 291/[1989] 175 ITR 574 (AP). In this case, the Court held that it was proper on the part of revenue to ensure and verify that the provisions of sections 12, 12A, 12AA and 13 were duly complied by the assessee before availing exemption under section 11.

The following are the conditions as provided in section 12A(1) which are to be fulfilled in order to be eligible for applicability of the provisions of sections 11 and 12:

(i) The organisation should have been registered under section 12AA/12AB of the Income-tax Act.

(ii) If the trust or institution has adopted or undertaken modifications of the objects which do not conform to the conditions of registration, then it is required to make an application for fresh registration.

(iii) Keep and maintain books of account and other documents in such form and manner and at such place, as may be prescribed.

(iv) Audit report mandatorily needs to be obtained and furnished one month prior to due date of filing the return under section 139(1). (after Finance Act, 2020)

(v) Income-tax return has to be furnished for the previous year in accordance with the provisions of sub-section (4A) of section 139, within the time allowed under that section [as per section 12A(ba)].

4. Computation of Income Available for Application

As a first step, a trust should compute income from trust property which shall be eligible for exemption and then amount applied for charitable/religious purposes should be determined and can be claimed as exemption.

4.1 Computation of Income Available for Application/Exemption

As per Circular No. 5-P(LXX6), dated June 19, 1968, the income from trust property shall be computed in commercial sense and not as per normal computation of income.

Exempt income [other than section 10(1), 10(23C) and 10(46)] will not be excluded but shall form part of income subject to application.

Fund raising expenses or expenses incurred to earn income should be deducted while computing the income as a charge against income.

Depreciation will not be considered as charge against income w.e.f. 1-4-2015 (assessment year 2015-16) if the asset has been claimed as application.

Exempt portion of anonymous donation shall form part of income subject to application.

4.2 Application of Income

The amount of application for charitable/religious purpose shall include –

- Revenue & capital nature of application

It is permissible to claim both revenue & capital nature of application provided it is used for charitable/religious purposes.

- Repayment of Loan

If the expenses are incurred out of loan, then there is no application out of income in the year of expenses being incurred but in such cases repayment of loan shall be considered as application in the year in which loan is repaid.

- The Finance Act, 2021 provides that an application from loans and borrowings shall not be considered as an application for charitable or religious purposes, However, when such loan or borrowing is repaid from the income of the previous year, such repayment shall be allowed as an application in the previous year in which it is repaid and to the extent, it is repaid.

- Therefore, application from loans and borrowings shall not be considered as an application for charitable or religious purposes for the purposes of the Third Proviso of Section 10(23C) and clauses (a) and (b) of section 11(1). However, when loan or borrowing is repaid from the previous year’s income, such repayment shall be allowed as an application in the previous year in which it is repaid to the extent of such repayment.

- Inter charity donation other than towards corpus

Inter charity donation other than towards corpus fund shall be considered as application for the purpose of section 11 of the Income-tax Act, 1961. However, it is to be ensured that inter charity donation are used on similar objects. Hence, inter charity donation can be for specified purposes as per the objects of the donor trust and to the donee trust having similar objects. In case unrestricted or voluntary contribution are given as inter charity donation, then it is desirable that the objects of the donee organisation are also dominantly similar with the donor organisation.

- Administrative expenses

Administrative expenses are normally related to both earning of income as well as for application of income and therefore, in certain cases, the tax department has taken the view that administrative expenses should be deducted while computing the income instead of treating these expenses as application of income for charitable & religious purpose. However, all the administrative expenses should be allowed as application of income so long as these expenses are not directly attributable to earning income.

- Activity outside India

Organisations created before 1-4-1952 can apply income outside India also. Organisations created on or after 1-4-1952 can apply income outside India for charitable purposes which tend to promote international welfare in which India is interested. These organisations will not get exemption unless CBDT specifically permits to work outside India or notifies the purposes which tend to promote international welfare in which India is interested.

- Specific disallowances of application amount

a. The amount of application shall be reduced by 30% of the corresponding amount applied for because of non-compliance of TDS provisions or by the full amount if the corresponding payment in excess of ` 10,000 is made in cash.

b. Inter-charity donation – Corpus grant to other trust registered under section 12AA shall not to be considered as application [w.e.f. A.Y. 2018-19]. Hence, any contribution by a charitable or religious trust registered under section 12AA to any other trust registered under section 12AA, with a specific direction that it shall form part of corpus of recipient trust, shall not be treated as application of income for the donor trust.

- Corpus Donations

The Finance Act, 2020 also provides that any corpus donation made by trust or institution registered under section 12AA to any fund or trust or institution or any university or other educational institution or any hospital or other medical institution referred to in sub-clause (iv) or sub-clause (v) or sub-clause (vi) or sub-clause (via) of section 10(23C) shall not be treated as an application of income.

Hence, in view of this amendment by Finance Act, 2020, corpus donation given by a section 12AA registered institution to section 10(23C) approved institution will not be treated as an application of income.

- Application on Payment Basis

The Finance Act, 2022 inserted an Explanation to Section 11 to explicitly provide that any sum payable by any trust shall be considered an application of income in the previous year in which such sum is actually paid. Thus, the application of income shall be allowed only on a payment basis.

This is irrespective of the previous year in which the liability to pay such sum was incurred by such trust according to the method of accounting regularly employed.

A proviso to the Explanation further provides that where any sum has been claimed to have been applied by such trust during any previous year, such sum shall not be allowed as an application in any subsequent previous year.

4.3 Once the income subject to application and the amount applied towards charitable/religious purposes is summarised and calculated, then it needs to be verified whether total application is at least 85 per cent of its income. The organisation can accumulate 15% of its income indefinitely without any condition.

If the organisation is unable to apply at least 85 per cent of its income as aforesaid where the income is accrued but not received or due to any other reason,then the organisation can exercise the option of applying such income in the immediately succeeding year or the year in which the income is received. [Explanation 2 to section 11(1)].

If the organisation is unable to apply at least 85 per cent of its income then it can also opt for accumulating the portion of income which could not be applied on a specific declared purpose. Such accumulated income should be applied within the next 5 years, failing which the income will become taxable. Once the income is accumulated, it should not be used for purposes other than for which it was accumulated. Further, inter-charity donations are not possible out of accumulated income. [Section 11(2]

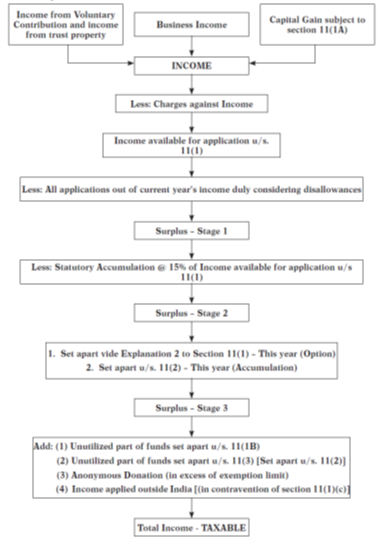

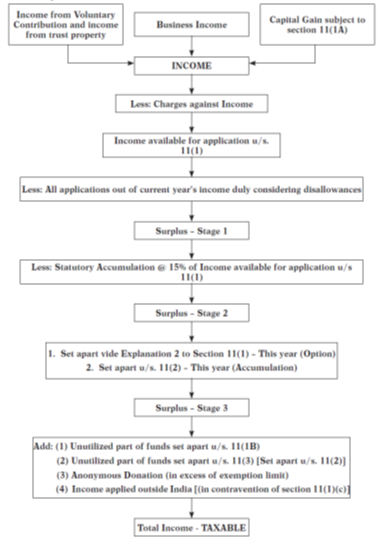

5. Flow Chart Showing Scheme of Taxation

For greater clarity on scheme of Taxation under section 11 the flow chart has been provided here under:

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

2 thoughts on “Trusts & NGOs | Scheme of Taxation & Computation of Income”

A Ravichandran says:

Beneficial to auditors. Good.

NABAJIT TALUKDAR says:

TRIBAL WELFARE SOCIETY

PLOT NO. 1/4, WEST KIDWAI NAGAR, NEW DELHI – 110023 Assessment Year : 2023-2024 Accounting Year : 2022-2023

S t a t u s : AOP PAN :

Date of Formation : Particulars Rupees only INCOME FROM BUSINESS / PROFESSION

Voluntary Contribution (non specific) 1,761,777

1,761,777 Gross Total Income 1,761,777

Less: Accumulation not exceeding 15% 264,266

1,497,510

Less: Amount applied for Charitable purpose (to the extent of available profit) 1,497,510 U/S. CH.NO. & DATE AMOUNT Assessable Income NIL

———NIL——— Rounded to NIL

Tax Payable NIL

Tax paid NIL

Refundable NIL

Leave a Reply Cancel reply

Sign Up

To subscribe to our weekly newsletter please log in/register on Taxmann.com

Latest Books

Income Tax Rules

Finance Act 2023 Essentials Combo

Finance Act 2023 Commentary Combo